Millions of Americans who rely on Social Security are expected to see higher monthly payments starting in January 2026, with $2064 SSA checks January 2026 becoming the new average for retired workers following a cost-of-living adjustment tied to inflation.

The increase, while modest by historical standards, arrives at a time when seniors, disabled Americans, and low-income households continue to face elevated costs for housing, healthcare, and food.

$2064 SSA Checks

| Key Fact | Detail |

|---|---|

| Average retired worker benefit | About $2064 per month in 2026 |

| COLA rate | Approx. 2.8% |

| First payment date | January 2026 (SSI paid Dec. 31, 2025) |

| Programs affected | Social Security, SSI, SSDI, VA benefits |

The shift toward $2064 SSA checks January 2026 reflects both easing inflation and ongoing cost pressures facing older and disabled Americans. While the increase provides needed relief, it also underscores the importance of broader discussions about retirement security and healthcare affordability.

What Is Driving the $2064 Social Security Payment?

The increase behind the $2064 SSA checks January 2026 stems from the annual cost-of-living adjustment (COLA), a mechanism designed to prevent inflation from eroding benefit value over time.

The Social Security Administration calculates COLA using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks changes in prices for essential goods and services such as housing, groceries, transportation, and medical care.

When inflation remains elevated—as it has in recent years—the CPI-W reflects those increases, triggering an automatic benefit adjustment. For 2026, inflation moderated compared with earlier post-pandemic peaks but remained high enough to justify a measurable increase.

Economists note that while COLAs are reactive rather than proactive, they remain one of the few inflation protections embedded directly into federal benefit programs.

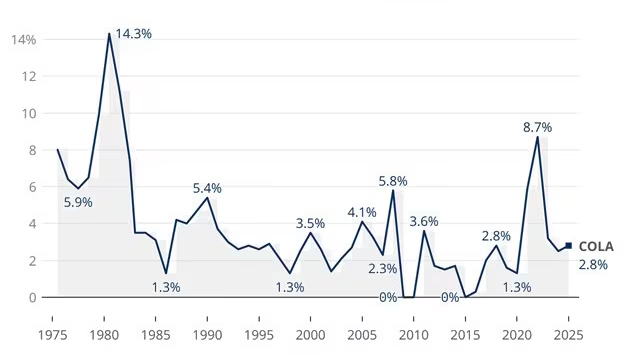

How the 2026 COLA Compares to Recent Years

The 2026 adjustment follows a period of unusually large COLAs earlier in the decade, driven by pandemic-era inflation.

In 2022 and 2023, beneficiaries saw some of the largest percentage increases in more than four decades. While those adjustments provided significant relief, they also highlighted how sharply costs had risen, particularly for rent, utilities, and healthcare.

By comparison, the 2026 COLA is smaller but more consistent with long-term historical averages. Analysts say this suggests inflation is stabilizing, even if prices remain higher than pre-pandemic levels.

Who Will Receive Higher Payments in 2026?

The 2026 COLA applies broadly across federal benefit programs administered by the SSA, impacting tens of millions of Americans.

Retired Workers

Retired workers represent the largest beneficiary group. For them, the $2064 SSA checks January 2026 figure represents an average, not a universal amount.

Actual benefits vary depending on factors such as lifetime earnings, age at retirement, and whether the worker claimed early or delayed benefits. Those who delayed retirement beyond full retirement age generally receive higher monthly payments.

SSI Recipients

Supplemental Security Income (SSI) serves elderly, blind, and disabled individuals with limited income and resources. The 2026 COLA increases the maximum federal SSI payment, though many recipients receive less due to state supplements or income offsets.

Advocates argue that even with COLAs, SSI benefits remain well below the federal poverty line, limiting their ability to fully cover housing and medical expenses.

SSDI Beneficiaries

People receiving Social Security Disability Insurance (SSDI) will see the same percentage increase applied automatically. SSDI beneficiaries often rely on their payments as their primary or sole income source.

Because SSDI recipients tend to be younger than retirees, rising healthcare and transportation costs can disproportionately affect their budgets.

VA Beneficiaries

Veterans receiving disability compensation or pensions tied to COLA formulas will also see higher payments. While the Department of Veterans Affairs administers these programs separately, COLA alignment ensures consistency across federal benefits.

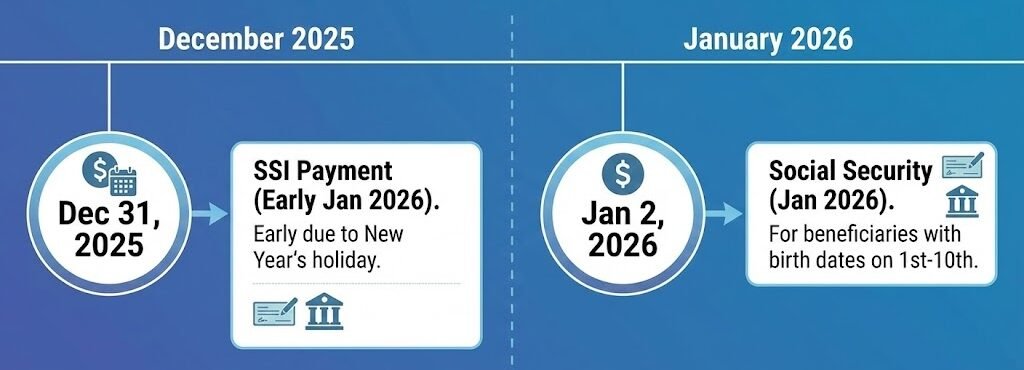

When Will the Higher Payments Arrive?

Most beneficiaries will receive their first increased payment in January 2026, following the SSA’s established payment schedule based on birth dates.

SSI recipients are an exception. Because January 1 is a federal holiday, SSI payments reflecting the 2026 COLA will be issued on December 31, 2025.

The SSA has emphasized that beneficiaries do not need to take any action. The increase will be applied automatically, and updated benefit notices will be mailed in December 2025.

The Bigger Picture: Inflation, Medicare, and Net Gains

While the headline $2064 SSA checks January 2026 figure signals progress, experts caution that rising Medicare costs could offset part of the increase for many beneficiaries.

Medicare Part B premiums are typically deducted directly from Social Security payments. If premiums rise faster than the COLA, the net increase beneficiaries see may be smaller than expected.

Healthcare economists note that older Americans spend a higher share of their income on medical expenses than younger households, making even modest premium increases significant.

“COLAs are essential, but they do not fully capture seniors’ real spending patterns,” said a retirement policy analyst at a U.S. think tank. “Healthcare inflation often runs hotter than general inflation.”

Impact on Low-Income and Fixed-Income Households

For low-income households, Social Security and SSI often account for the majority of monthly income. In these cases, even a small increase can affect food security, medication adherence, and housing stability.

The SSA estimates that Social Security benefits lift more than 20 million Americans out of poverty each year. Without annual COLAs, that figure would likely be far lower.

However, nonprofit organizations stress that COLAs maintain purchasing power rather than improving living standards. When prices remain elevated, beneficiaries may still struggle to meet basic needs.

Regional Differences in Cost Pressures

One limitation of the COLA formula is that it does not account for regional variations in living costs.

Housing and healthcare costs in large metropolitan areas often rise faster than national averages. Beneficiaries living in high-cost regions may feel that COLA increases lag behind real-world expenses.

Some lawmakers have proposed alternative inflation measures that better reflect senior spending patterns, though such changes would require congressional action.

Long-Term Questions About Social Security’s Future

The 2026 increase also arrives amid broader debates about the long-term financial health of Social Security.

According to trustees’ projections, the program’s trust fund could face shortfalls in the coming decade without legislative changes. While benefits would not disappear, payments could be reduced if Congress does not act.

Policy proposals range from adjusting payroll taxes to modifying benefit formulas or raising the retirement age. Each option carries political and economic trade-offs.

Experts stress that COLAs like the 2026 adjustment operate independently of these long-term solvency issues, but they remain part of the broader conversation.

What Beneficiaries Should Watch Next

Beneficiaries are encouraged to review their annual COLA notice carefully, paying attention to deductions for Medicare premiums or other withholdings.

Financial advisors recommend using the increase strategically, prioritizing essential expenses and debt reduction where possible.

For those still working while receiving benefits, changes in earnings could also affect net payments due to income limits.

FAQ

Will everyone get exactly $2064?

No. The $2064 figure represents an average. Individual benefits depend on earnings history, benefit type, and deductions.

Do I need to apply for the 2026 increase?

No. The SSA applies COLA increases automatically to all eligible beneficiaries.

Does this affect spousal or survivor benefits?

Yes. Spousal and survivor benefits increase by the same COLA percentage.

Will this increase affect taxes on Social Security?

Possibly. Higher benefits may push some recipients closer to income thresholds where a portion of benefits becomes taxable.