$2200 IRS Child Tax Credit Payment In 2026: Raising kids is expensive, and tax time is when most families try to claw back some breathing room through credits and refunds. If you’ve been seeing posts about a $2200 IRS Child Tax Credit Payment in 2026, the important thing to understand is this: for most people, it isn’t a separate monthly check showing up automatically. It’s a tax credit you claim on your return, and the “payment” usually arrives as part of your tax refund after you file.

Now here’s why so many people are talking about it. The Child Tax Credit has a maximum amount that can change based on law and inflation adjustments, and families naturally want to know what they can get, whether they qualify, and when the money could actually hit their bank account. This guide breaks down the $2200 IRS Child Tax Credit Payment in 2026 in plain English, including deposit timing, eligibility rules, and what to do to avoid refund delays.

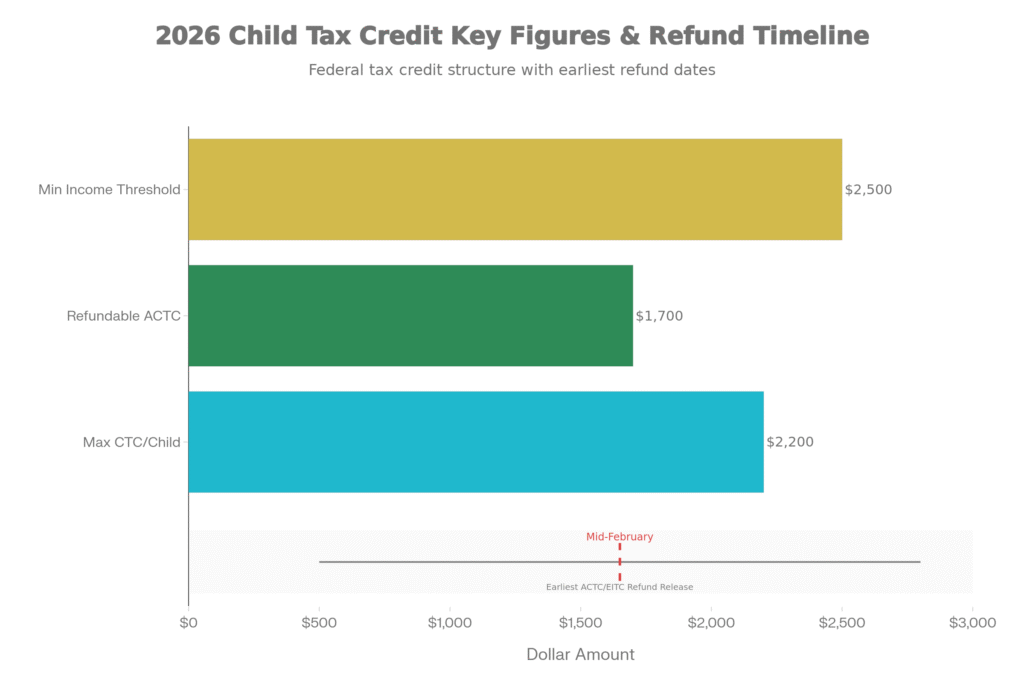

When people say $2200 IRS Child Tax Credit Payment in 2026, they’re usually referring to the maximum Child Tax Credit amount per qualifying child for the tax year they’re filing for. In most cases, you don’t receive this money automatically; you receive it after you file your federal return and the IRS processes it, either reducing what you owe or increasing your refund. If part of the credit is refundable for you, the refundable portion is commonly tied to the Additional Child Tax Credit rules, which can affect both how much you receive and when it can be released.

$2200 IRS Child Tax Credit Payment In 2026

What Is The $2200 Child Tax Credit

- The Child Tax Credit (CTC) is designed to reduce a family’s federal tax bill for each qualifying child. If you owe taxes, the credit can reduce what you owe dollar-for-dollar up to the allowed amount. If you don’t owe much tax, you may still qualify for a refundable portion, which can turn into an actual refund.

- This is where the confusion starts online. People often call it a payment because, in real life, many households see the benefit as cash in their bank account when the IRS issues their refund. But structurally, it’s a credit claimed on your return, not a guaranteed deposit sent out to everyone on one day.

Deposit Schedule For 2026

There isn’t one universal deposit date for the $2200 IRS Child Tax Credit Payment in 2026 because the timing depends on when you file, how you file, and whether your return needs extra review. In general, the fastest path is to e-file an accurate return and choose direct deposit, because paper returns and mailed checks usually take longer. Another key timing issue: if your refund includes the Additional Child Tax Credit or the Earned Income Tax Credit, refunds are generally not released before mid-February due to federal rules designed to reduce fraud. That doesn’t mean everyone gets paid in mid-February; it means the IRS can’t release those refunds before that point, and your actual deposit date still depends on processing and your bank.

If you want the most realistic expectation, think in windows, not exact dates:

- Early filers without issues may see refunds sooner once processing begins.

- Filers claiming refundable credits may see a built-in delay into mid- to late-February or beyond.

- Returns with errors, missing SSNs, mismatched dependent data, or identity verification steps can take significantly longer.

Eligibility Requirements

Eligibility is where the IRS is very specific, and small mistakes can cause big delays. To qualify for the Child Tax Credit, your child generally must meet the IRS definition of a qualifying child, including age and dependency rules.

Here are the eligibility points that most often decide whether you qualify and how much you get:

- Age test: The child must be under age 17 at the end of the tax year.

- SSN requirement: The child must have a Social Security number valid for employment, issued before the due date of the return (including extensions).

- Dependent and relationship rules: You must be able to claim the child as your dependent and meet relationship and residency-related requirements under IRS rules.

- Income limits and phaseout: The credit may be reduced as income rises above certain thresholds based on filing status.

- Refundable portion rules: If you’re expecting “cash back” beyond your tax liability, refundable eligibility and earned-income thresholds matter.

If you’re married filing jointly, head of household, or a single parent with shared custody, it’s especially important to claim the child correctly only one taxpayer can claim the same qualifying child for the credit in the same year.

How The Refundable Portion Works

Many families care less about the credit concept and more about one question: will this increase the refund? That depends on whether you qualify for the refundable portion. The IRS explains that up to a set amount of the Child Tax Credit can be refundable (often discussed as the Additional Child Tax Credit) if you meet the rules. One commonly referenced rule is that you generally need at least $2,500 in earned income to qualify for the refundable portion.

In practical terms:

- If you have tax liability, the CTC can reduce what you owe.

- If you have low or no tax liability, you may still receive a refund up to the refundable limit if you qualify.

- If your earned income is too low, you might not get the refundable part even if you have a qualifying child.

How To Claim the Child Tax Credit

Claiming the $2200 IRS Child Tax Credit Payment in 2026 starts with filing a federal income tax return, even if you wouldn’t otherwise be required to file. Most people claim the credit on Form 1040 and use Schedule 8812 to calculate the credit and any refundable portion when required.

To claim smoothly:

- Make sure your child’s name and SSN match Social Security records.

- Confirm the child meets the age rule for the year you’re filing.

- Double-check filing status and dependent entries, because a simple mismatch can hold up processing.

- E-file and choose direct deposit if your goal is the fastest possible refund timeline.

Common Reasons Refunds Get Delayed

If your goal is getting your refund as fast as possible, avoiding delays matters as much as eligibility. Some of the most common issues that slow things down include identity verification requests, errors in dependent details, and refundable credit timing rules.

Watch out for:

- Incorrect SSN or child name spelling differences compared with Social Security records.

- Claiming a child that someone else already claimed.

- Math errors or missing forms, including items connected to Schedule 8812.

- Refunds involving refundable credits that are legally held until mid-February.

What To Do If You Don’t Receive It

If you expected the $2200 IRS Child Tax Credit Payment in 2026 and it doesn’t show up, the first step is to confirm whether you actually claimed it correctly on your return. Next, verify whether your refund includes refundable credits that can push timing later into the season.

Practical steps that help:

- Use the IRS refund tracking tool to see whether the return is received, approved, or sent.

- Review your filed return for dependent info and SSNs.

- If the IRS requests identity verification or additional documentation, respond quickly because refunds often pause until that step is complete.