After weeks of warning beneficiaries about “final” deadlines, the U.S. government is now quietly retreating from plans to end Social Security paper checks, a move that has raised concerns about communication failures and public trust. The Social Security paper checks policy shift follows mounting pressure from advocates and lawmakers who warned that millions of vulnerable recipients could face serious barriers to accessing their benefits.

Social Security Paper Checks

| Key Fact | Detail |

|---|---|

| Original policy goal | End most federal paper checks by 2025 |

| Population affected | Fewer than 1% of Social Security recipients |

| Current status | Social Security paper checks will continue for some recipients |

What the Government Originally Planned

Earlier this year, the U.S. Treasury Department, working with the Social Security Administration (SSA), announced plans to phase out paper checks for nearly all federal benefit programs by late 2025. The initiative included Social Security retirement benefits, Supplemental Security Income, and disability payments.

Officials said the move was part of a long-term effort to modernize federal payment systems. According to Treasury data, electronic payments are significantly cheaper to process than physical checks, which require printing, mailing, and fraud prevention measures. Treasury officials estimate that issuing Social Security paper checks costs taxpayers several dollars per payment, compared with only cents for electronic transfers.

The government also cited security concerns. Paper checks are more likely to be stolen, altered, or delayed, particularly in areas with unreliable mail service. During the COVID-19 pandemic, thousands of beneficiaries reported missing or late checks, reinforcing the administration’s view that electronic payments are more resilient.

Public messaging around the plan was forceful. Mailings, online notices, and automated phone messages repeatedly described upcoming deadlines as “final,” urging remaining recipients to enroll in direct deposit or the government-backed Direct Express debit card.

Why Officials Are Now Reversing Course

Despite the efficiency arguments, the policy drew sharp criticism from advocacy organizations, including groups representing seniors, people with disabilities, Native American communities, and residents of rural areas. These groups argued that even a small percentage of affected beneficiaries represents hundreds of thousands of people who still rely on Social Security paper checks.

Advocates pointed out that some recipients lack bank accounts, reliable internet access, or the technical skills required to manage digital payments. Others face cognitive impairments or live in areas where prepaid debit cards are difficult to use.

In response to growing concerns, lawmakers from both parties contacted the SSA and Treasury Department, warning that a strict cutoff could trigger benefit disruptions and political backlash. Several members of Congress publicly urged agencies to provide permanent exemptions for Social Security paper checks.

In a statement later shared with national media outlets, an SSA spokesperson said the agency would “continue issuing paper checks for individuals who cannot reasonably access electronic payment methods,” clarifying that benefits would not be terminated solely for failing to switch.

Policy analysts say the change reflects the limits of administrative authority. “Federal agencies can encourage modernization, but they still have a legal obligation to ensure access,” said a former senior SSA official interviewed by Reuters. “If people cannot reasonably comply, the government has to accommodate them.”

A Communication Breakdown

While the policy adjustment resolved some concerns, the way it unfolded has drawn criticism from experts in public administration. Many beneficiaries believed the deadlines were absolute and irreversible, leading to confusion and anxiety.

SSA field offices and call centers reported increased call volumes following the warnings, according to agency employees and union representatives. Staff shortages and long wait times made it difficult for recipients to get clarification about Social Security paper checks.

“The issue isn’t just the policy—it’s the messaging,” said a public policy professor at a major U.S. university. “When government agencies use language like ‘final deadline,’ people take that literally.”

The SSA later updated online guidance to soften the language around deadlines. However, the agency did not issue a high-profile press release or direct mailing explaining the continued availability of Social Security paper checks, contributing to the perception that the policy change was handled quietly.

Historical Context: How Social Security Payments Evolved

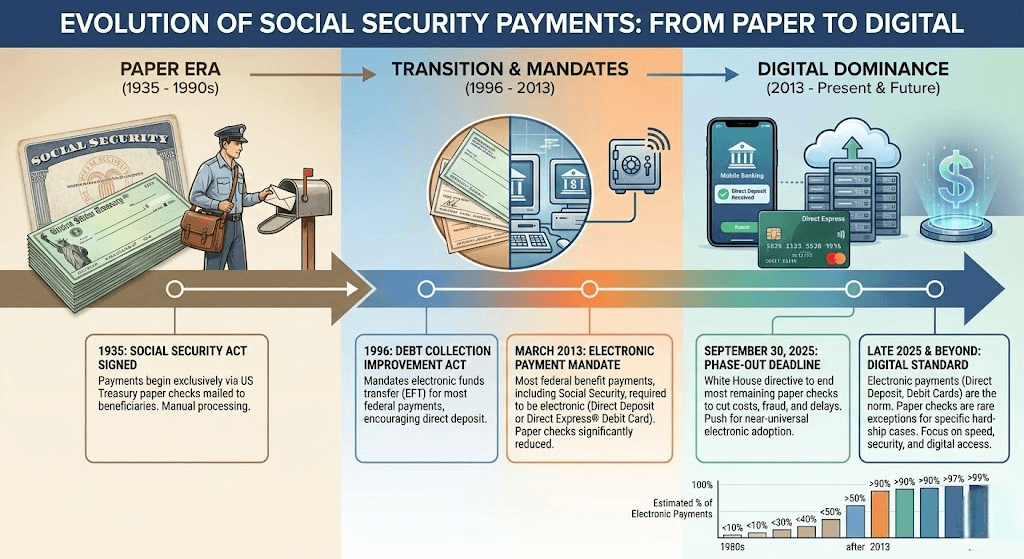

Social Security checks were once the dominant method of benefit distribution. When the program launched in the 1930s, mailed checks symbolized government reliability and stability.

The shift toward electronic payments began gradually in the 1990s and accelerated in the 2000s as direct deposit became widespread. By the early 2010s, the government required most new beneficiaries to enroll electronically, though exemptions for Social Security paper checks remained.

Today, according to SSA data, more than 99% of beneficiaries receive payments electronically. The remaining fraction, while small, includes some of the country’s most economically and socially vulnerable individuals.

How the Policy Fits Into a Larger Trend

The debate over Social Security paper checks mirrors broader efforts across the federal government to digitize public services. Tax refunds, veterans’ benefits, and unemployment payments have all moved increasingly toward electronic delivery.

Supporters argue digital systems reduce waste, fraud, and administrative burden. Treasury officials say electronic payments are easier to track and audit, improving program integrity.

Critics caution that rapid digital transitions can exacerbate inequality. Studies from organizations such as the Pew Research Center show that older adults, low-income households, and rural residents are less likely to have consistent access to banking services and broadband internet.

Internationally, similar debates have unfolded in countries that aggressively reduced cash and paper-based systems. Research from the World Bank suggests that while digital payments improve efficiency, governments must maintain fallback options such as Social Security paper checks to avoid exclusion.

Political and Administrative Implications

The quiet reversal may carry political consequences. Trust in government institutions, particularly among seniors, is closely tied to the reliability of Social Security payments.

Lawmakers have warned that even the perception of benefit instability can erode confidence in the program. Several members of Congress have called for clearer statutory protections to ensure Social Security paper checks remain available when needed.

Administratively, the SSA must now balance modernization goals with individualized assessments of hardship. That process could require additional staff training and clearer guidelines for granting exemptions related to Social Security paper checks.

What Happens Next

Treasury and SSA officials say they will continue encouraging electronic payments while maintaining flexibility for those who cannot transition. Over time, eligibility criteria for Social Security paper checks may become more formalized.

For now, agency officials emphasize that no beneficiary will lose access to Social Security solely because they rely on mailed checks. “Our responsibility is to deliver benefits reliably,” one senior Treasury official told the Associated Press. “Modernization should expand access, not limit it.”

The episode has prompted renewed calls for clearer communication and stronger safeguards as the government continues to update its payment systems.

FAQ

Will Social Security paper checks end completely?

No. Officials say Social Security paper checks will remain available for recipients who cannot reasonably use electronic payments.

Do beneficiaries need to take action immediately?

No immediate action is required. Electronic payments are encouraged but not mandatory for those facing hardship.

Why did the government change its position?

Advocacy pressure, legal considerations, and concerns about access for vulnerable populations led to the adjustment.

How common are Social Security paper checks today?

Fewer than 1% of beneficiaries still receive Social Security paper checks, according to the SSA.