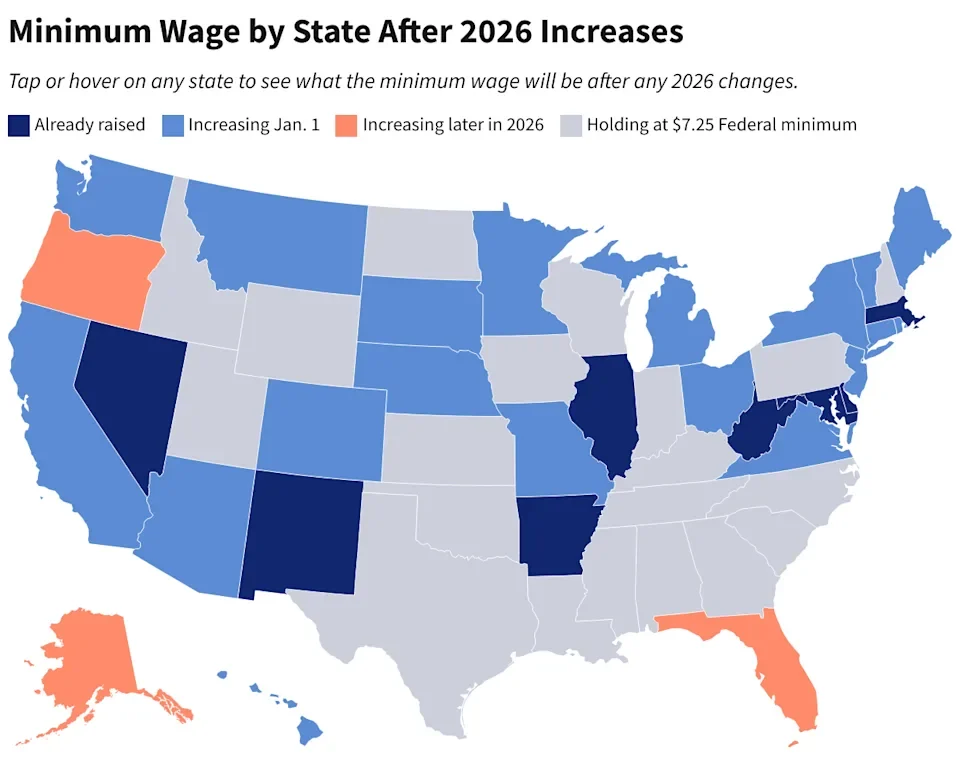

USA Minimum Wage Changes are reshaping paychecks across much of the country in 2026, lifting hourly wages for millions of workers as states respond to persistent inflation and rising living costs. While the federal minimum wage remains frozen at $7.25 per hour, a growing number of states and cities are moving ahead with higher pay standards, widening economic differences between regions.

USA Minimum Wage Changes

| Key Fact | Detail |

|---|---|

| Federal minimum wage | $7.25 per hour, unchanged since 2009 |

| States raising wages in 2026 | 19 states with scheduled increases |

| Highest minimum wage | Washington, D.C., nearly $18 per hour |

Federal Minimum Wage Remains Unchanged

The federal minimum wage, established under the Fair Labor Standards Act, has remained at $7.25 per hour since July 2009, according to the U.S. Department of Labor. Adjusted for inflation, that rate is now worth significantly less than it was when last raised, reducing its purchasing power by more than 30 percent.

Congress has repeatedly debated legislation to raise the federal minimum wage, including proposals to gradually increase it to $15 per hour. However, those efforts have stalled.

Supporters argue a higher federal floor would help low-income workers nationwide and reduce reliance on public assistance. Opponents counter that a uniform national rate fails to account for cost-of-living differences and could increase labor costs for small businesses in lower-income regions.

“Without congressional action, the federal minimum wage has effectively become irrelevant in much of the country,” said Ben Zipperer, an economist at the Economic Policy Institute. “States are filling that policy vacuum.”

States Drive the Latest USA Minimum Wage Changes

Most USA Minimum Wage Changes taking effect in 2026 result from laws passed years earlier that mandate automatic annual increases or link wages directly to inflation.

States including Washington, Oregon, and Colorado adjust their minimum wages each year based on changes in consumer prices. In others, such as California and New York, lawmakers approved multi-year wage schedules that are still being phased in.

Washington state now has one of the highest minimum wages in the nation, exceeding $17 per hour following its latest inflation adjustment. California’s statewide rate has also continued to climb, while New York maintains different wage levels depending on region and employer size.

These increases reflect a broader trend. According to the National Conference of State Legislatures, more than half of U.S. states now have minimum wage laws that rise automatically, insulating pay from political gridlock.

A Patchwork of State-by-State Rules

The result is a highly fragmented national system.

Some states, including Alabama, Texas, and Pennsylvania, do not set their own minimum wage. In those states, most workers remain subject to the federal $7.25 rate.

Other states operate under more complex frameworks. New York applies different minimum wages for New York City, surrounding suburban counties, and the rest of the state. Minnesota and Montana distinguish between large and small employers. Several states maintain separate training or youth wages for younger workers.

Michigan’s minimum wage is increasing under a compromise reached after years of legal and political disputes. The state’s wage is expected to reach roughly $13.70 per hour in 2026, with further increases scheduled.

Virginia uses a different model. Its minimum wage rises automatically based on inflation, resulting in smaller but predictable annual changes.

“This patchwork reflects political realities,” said Laura Dresser, an economist at the University of Wisconsin–Madison. “States are balancing worker protections with regional economic conditions.”

Impact on Workers and Businesses

For workers, higher minimum wages often translate into immediate gains. Research from the Brookings Institution shows that low-wage earners typically spend most of their additional income locally, supporting consumer demand.

Higher wages can also reduce employee turnover, a persistent problem in retail, food service, and hospitality sectors. Employers in high-cost cities report that better pay can improve recruitment and retention.

Business groups, however, remain divided. The National Federation of Independent Business has warned that rapid wage increases can strain small employers, particularly those operating on thin margins. Some owners say they respond by raising prices, reducing hours, or delaying hiring.

Large employers often adapt more easily. National chains can spread higher labor costs across multiple locations, while smaller businesses have fewer options.

Economists remain split on the long-term effects. Most studies find modest wage increases have little impact on employment, but larger jumps can produce mixed outcomes depending on local conditions.

Who Is Most Affected by Minimum Wage Changes

Minimum wage workers are disproportionately young, female, and people of color, according to data from the Bureau of Labor Statistics. Many work in service industries such as restaurants, retail, caregiving, and hospitality.

However, the majority are not teenagers. Roughly half are over the age of 25, and many support families.

Higher minimum wages also have ripple effects. Employers often raise pay for workers earning just above the minimum to maintain wage ladders, extending benefits beyond those directly covered.

At the same time, tipped workers face a different reality. In many states, employers may pay a lower cash wage if tips bring total earnings up to the minimum. Critics argue this system creates income instability and exposes workers to wage theft.

Local Wages Often Go Even Higher

Beyond state laws, many cities and counties have enacted their own minimum wages that exceed statewide requirements.

Seattle, San Francisco, and several California counties now require employers to pay well above $18 per hour. These local laws often include additional worker protections, such as paid sick leave or predictable scheduling rules.

The U.S. Department of Labor advises that when multiple wage laws apply, workers are entitled to the highest applicable rate.

Local wage laws can complicate compliance for employers operating in multiple jurisdictions, leading to increased demand for payroll and human resources support.

The Political Debate Ahead

Minimum wage policy remains politically contentious.

Supporters argue that wages must rise to reflect modern living costs and productivity gains. Labor unions and advocacy groups continue to push for a higher federal floor, framing the issue as one of economic fairness.

Opponents argue that wage policy should remain local, warning that a high federal minimum could harm rural economies or accelerate automation.

With national elections approaching, the issue is expected to remain prominent. Several states are considering ballot initiatives that would further raise wages in coming years.

What Comes Next

Further USA Minimum Wage Changes are already scheduled beyond 2026 in several states, while federal proposals remain unresolved.

Economists say future wage growth will likely depend on inflation trends, labor market tightness, and political momentum at both state and federal levels.

“The trajectory is clear,” said Zipperer. “Even without federal action, minimum wages are rising. The real question is how uneven that growth will be.”

FAQ

Is the federal minimum wage increasing in 2026?

No. The federal minimum wage remains $7.25 per hour unless Congress passes new legislation.

Do state minimum wages apply to all workers?

Most covered, non-exempt workers must be paid the state or local minimum wage, though exceptions exist for tipped, youth, and agricultural workers.

Which wage applies if laws conflict?

Employers must pay the highest wage required under federal, state, or local law.

Do higher minimum wages cause job losses?

Research shows mixed results. Most studies find modest increases have limited employment effects, though impacts vary by region and industry.