Claims that the IRS $2000 direct deposit would begin nationwide on January 1 have spread rapidly online, alarming and confusing millions of Americans. Federal officials, however, say no such payment has been authorized, and Congress has passed no legislation approving a new round of universal stimulus or relief funds.

$2000 Direct Deposit

| Key Fact | Detail |

|---|---|

| Universal $2,000 payment | No such payment authorized |

| Start date January 1 | No IRS announcement exists |

| Congressional approval | None passed |

| Common source of claims | Viral blogs and social media |

What Is Behind the IRS $2000 Direct Deposit Claims

Online headlines and social media posts have claimed the Internal Revenue Service confirmed a universal IRS $2000 direct deposit beginning January 1. Many posts describe the payment as automatic and available to all Americans, regardless of income or filing status.

No official government agency has made such an announcement.

The IRS, which administers payments authorized by Congress, has issued no guidance, press release, or notice indicating a new federal relief payment. The U.S. Department of the Treasury likewise reports no new disbursement program.

According to reporting by Reuters and the Associated Press, the claims stem from misinterpreted policy discussions, outdated stimulus references, and unverified blog posts that resemble legitimate news articles. These stories often use official-sounding language and government imagery, increasing their perceived credibility.

Media researchers say such claims tend to resurface cyclically, especially during periods of inflation, high interest rates, or major tax-season transitions.

How Quickly the Claims Spread Online

Within days of appearing on several low-profile websites, the IRS $2000 direct deposit claim was shared widely across social media platforms, discussion forums, and messaging apps.

Digital analytics firms tracking misinformation trends say financial rumors spread faster than most political falsehoods because they tap into immediate personal concern. Posts promising guaranteed money often outperform verified news content in engagement metrics.

“This type of claim spreads because it feels plausible,” said a misinformation analyst at a major U.S. university. “People remember stimulus checks, they know the IRS sends money, and they are primed to believe relief could return.”

No New Stimulus Has Passed Congress

Any nationwide payment distributed by the IRS requires explicit congressional authorization and presidential approval.

The most recent direct stimulus payments were issued under the Coronavirus Aid, Relief, and Economic Security Act and subsequent pandemic-era legislation between 2020 and 2021. Since then, Congress has debated—but not passed—any law approving a new universal cash payment.

“There is currently no legislation providing for additional stimulus checks,” the Congressional Research Service noted in its latest fiscal policy summary.

Budget analysts also point to the current federal deficit and divided Congress as factors making large-scale direct payments politically difficult. While lawmakers from both parties have proposed targeted tax credits or relief measures, none resemble a universal $2000 payment.

Why January 1 Keeps Appearing in Viral Reports

January 1 frequently appears in misleading claims because it coincides with the start of the tax year and changes to IRS administrative procedures.

This year, the IRS has expanded its push toward electronic filing and direct deposit for standard tax refunds. Officials have encouraged taxpayers to update banking details to avoid delays, particularly as paper checks are gradually phased out.

Some online posts appear to conflate routine tax refunds or credits with a new relief payment, according to media analysts who track financial misinformation.

“These claims recycle familiar language from the pandemic era,” said a senior researcher at the Brookings Institution. “They rely on confusion around tax refunds, credits, and stimulus checks.”

The Role of Artificial Intelligence and Content Farms

Experts say generative artificial intelligence has accelerated the spread of misleading financial content.

Automated websites can now generate hundreds of articles repeating the same claim with minor wording changes. Many are designed to rank in search results rather than provide verified information.

“These articles are not always written with malicious intent,” said a digital media researcher. “But they often lack editorial oversight, fact-checking, or accountability.”

As a result, readers searching for updates on stimulus payments may encounter dozens of nearly identical stories, all citing unnamed “reports” or “sources,” without linking to official documentation.

Experts Warn of Rising Misinformation Risks

Financial misinformation often surges during periods of economic uncertainty, experts say. Rising living costs and lingering memories of pandemic relief make cash-payment rumors especially persuasive.

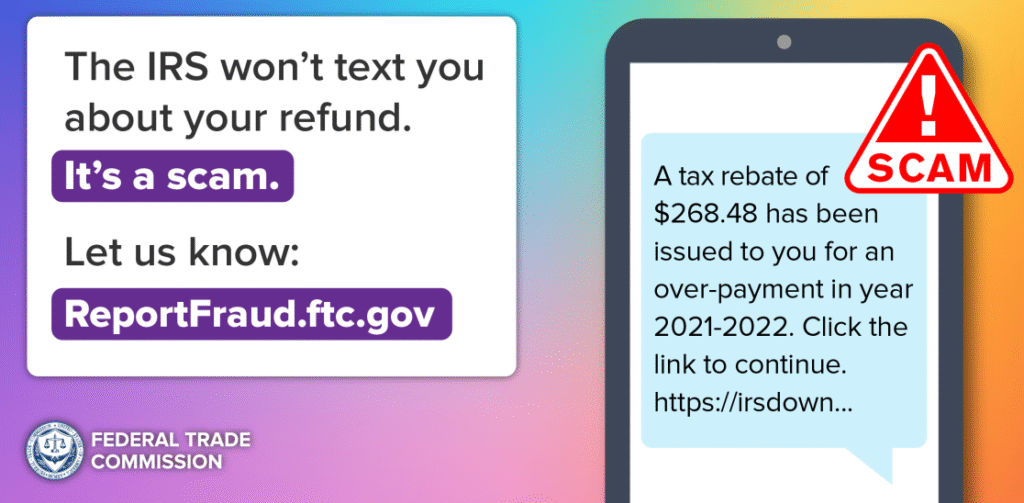

The Federal Trade Commission has warned consumers to be cautious of websites or messages promising guaranteed IRS payments or requesting personal banking information.

The IRS has repeatedly stated it does not initiate contact by email, text message, or social media regarding payments. Official communications are delivered through IRS.gov or mailed notices.

Scammers often exploit these viral claims by sending phishing messages that appear to confirm eligibility and request bank details or Social Security numbers.

What Payments the IRS Is Actually Issuing

While no universal $2000 payment exists, the IRS continues issuing routine refunds and credits, including:

- Standard income tax refunds

- Earned Income Tax Credit adjustments

- Child Tax Credit corrections

- State-level rebates administered separately from the IRS

These payments vary by taxpayer and are not universal.

Tax professionals note that refund amounts may appear larger this year for some filers due to withholding changes or credit eligibility, which can further fuel confusion.

Taxpayers can verify legitimate payments through the IRS “Where’s My Refund?” tool or their official IRS online account.

How to Verify Claims About IRS Payments

Consumer advocates recommend a few basic steps before trusting any claim about federal payments:

- Check IRS.gov for official announcements

- Look for confirmation from major news organizations

- Avoid websites that do not name sources

- Be wary of claims that promise “automatic” or “guaranteed” money

“If a payment were real, it would be impossible to miss,” said a former Treasury official. “Congressional approval, presidential signatures, and IRS guidance would all be public.”

What Happens Next

Federal officials say no new stimulus proposals are scheduled for immediate consideration. Lawmakers continue to debate broader fiscal policy issues, including tax reform and targeted relief, but none involve universal cash payments.

Until then, experts urge Americans to rely on official government sources and established news organizations for accurate financial information.

“The best defense against misinformation is patience and verification,” said one IRS spokesperson.

FAQs About $2000 Direct Deposit

Is the IRS sending everyone $2000?

No. There is no approved or announced universal payment.

Did the IRS confirm a January 1 payment date?

No official IRS statement supports that claim.

Could a $2000 payment happen later?

Only if Congress passes new legislation and the president signs it into law.

How can I verify real IRS payments?

Use IRS.gov tools or mailed IRS notices. Avoid third-party websites.

Why do these claims keep coming back?

They reuse familiar stimulus language and exploit tax-season uncertainty.