The phrase “Goodbye Retirement at 67” has captured national attention as millions of Americans come to terms with a critical reality: under current law, 67 is now firmly the full retirement age for Social Security for anyone born in 1960 or later. While the rule is not new, its full impact is now unavoidable—reshaping when Americans retire, how much they receive in benefits, and how long they may need to keep working.

New Social Security Age Rule

| Item | Detail |

|---|---|

| Full retirement age | 67 (born 1960 or later) |

| Earliest claiming age | 62 (with permanent reduction) |

| Delayed credits | Up to age 70 |

| Origin of rule | Social Security Amendments of 1983 |

What the “New” Social Security Age Rule Actually Is

Despite the dramatic framing, there is no sudden new law changing the retirement age in 2025 or 2026. Instead, this moment marks the completion of a decades-long transition first approved by Congress in 1983.

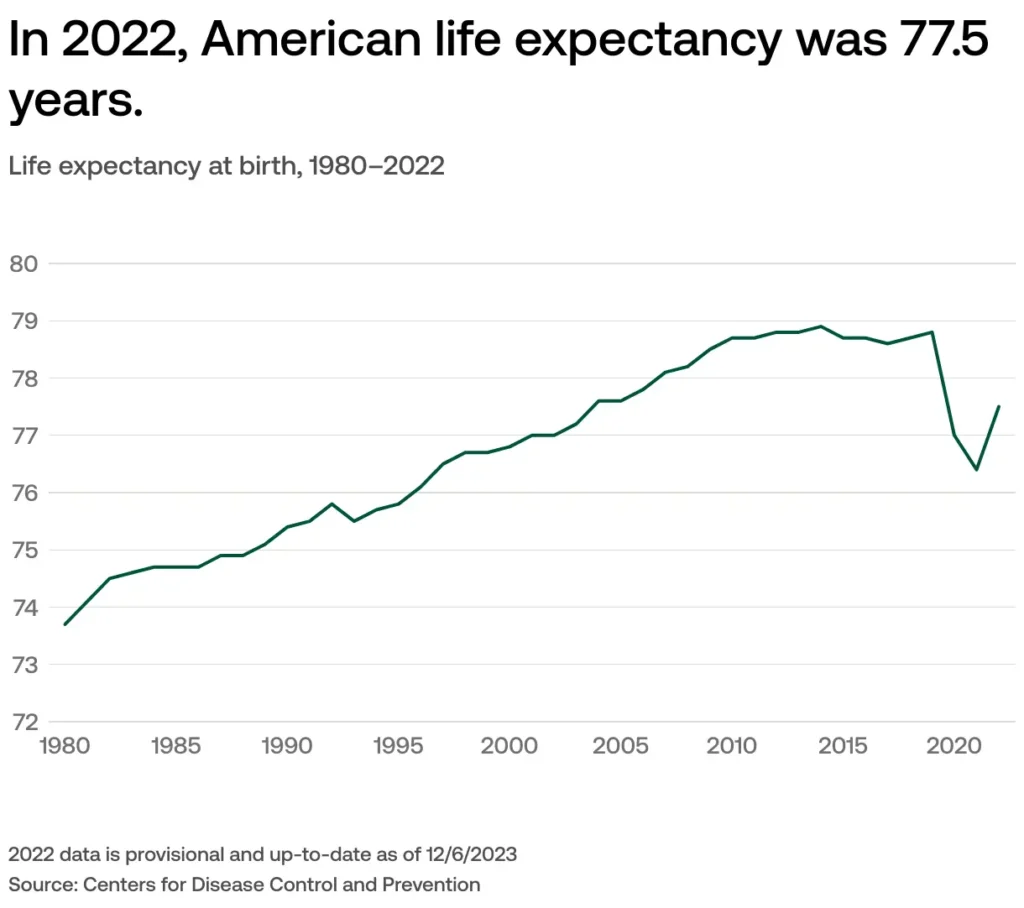

Under amendments to the Social Security Act, lawmakers gradually raised the full retirement age (FRA) from 65 to 67 to reflect longer life expectancy and growing financial pressure on the system administered by the Social Security Administration.

- Born 1959 → FRA: 66 years, 10 months

- Born 1960 or later → FRA: 67

For the first time, an entire cohort of Americans now faces 67 as the baseline age for unreduced Social Security retirement benefits.

Why “Goodbye Retirement at 67” Feels Like a Shock

Many Americans assumed retirement would still center around ages 65 or 66, even as the rules quietly shifted. Surveys show a large share of workers do not know their full retirement age, leading to surprise when benefit estimates arrive.

The shock is amplified by today’s realities:

- Rising housing and healthcare costs

- Fewer workers covered by traditional pensions

- Insufficient personal retirement savings

- Longer life expectancy requiring income for more years

As a result, the formal arrival of age 67 feels less like a technical milestone and more like a breaking point for retirement expectations.

How Claiming Age Changes Monthly Benefits

Social Security does not dictate when you must stop working. Instead, it adjusts benefits based on when you claim.

Claiming at 62

- Earliest eligibility

- Monthly benefits reduced by about 30% for life

Claiming at 67

- Full retirement age

- 100% of earned benefit

Claiming at 70

- Maximum benefit

- Payments increase roughly 8% per year after FRA

This structure increasingly rewards those who can afford to wait—while penalizing those who cannot.

Why Retirement at 67 Is Harder for Some Americans

Physically Demanding Jobs

Workers in construction, healthcare support, manufacturing, and service roles may find it unrealistic to stay employed until 67.

Health Limitations

Chronic illness or disability often forces early claiming, locking in lower lifetime benefits.

Lower-Income Workers

Those with limited savings are more likely to claim early out of necessity, effectively turning the higher retirement age into a benefit cut.

Caregivers and Women

Career interruptions reduce lifetime earnings, making delayed claiming harder even though women often benefit more from higher monthly payments due to longer life expectancy.

Raising the Retirement Age as a Hidden Benefit Cut

Economists note that increasing the full retirement age functions as an indirect benefit reduction. Even if the law allows early claiming, the reality is that many people cannot wait until 67.

The result:

- Lower monthly checks for millions

- Greater inequality between high- and low-income retirees

- Increased reliance on personal savings and continued work

This dynamic is central to why the age rule remains controversial decades after its passage.

How Inflation and COLAs Interact With the Age Rule

Cost-of-living adjustments (COLAs) raise benefits annually, but they apply after claiming age decisions are locked in. A worker who claims early receives COLAs on a permanently smaller base benefit, compounding the long-term impact of early claiming.I n effect, the age rule and COLA system together magnify the consequences of retirement timing.

Labor Market and Economic Effects

The firm shift to age 67 has broader implications:

- More Americans working into their late 60s

- Increased demand for age-friendly workplaces

- Delayed job turnover for younger workers

- Greater strain on workers in poor health

While some older Americans welcome longer careers, others remain in the workforce purely out of financial necessity.

Common Myths About the Social Security Age Rule

Myth: You are required to retire at 67.

Fact: Retirement is voluntary; only benefit calculations change.

Myth: This rule was passed recently.

Fact: It was enacted in 1983 and phased in gradually.

Myth: Waiting until 67 guarantees financial security.

Fact: Social Security replaces only a portion of pre-retirement income.

Policy Debate: Will the Age Rise Again?

With long-term funding challenges ahead, some policymakers have proposed raising the full retirement age beyond 67. Others argue such changes would disproportionately harm vulnerable workers.

As of now:

- No law raises the retirement age above 67

- Any future changes would require congressional approval

- The debate remains politically and socially divisive

What Workers Can Do Now

Financial planners recommend preparation, not panic:

- Confirm your full retirement age

- Compare benefits at 62, 67, and 70

- Build supplemental savings where possible

- Factor health and longevity into decisions

- Seek personalized retirement guidance

Understanding the rules early gives workers more control over difficult trade-offs.

Related Links

Cash App Referral Text Lawsuit Resolved: What the $147 Settlement Means for Consumers

Looking Ahead

“Goodbye Retirement at 67” is less about a single rule and more about a broader transformation in how Americans age and work. The completion of the age-67 transition cements a new reality: Social Security is a foundation, not a full retirement solution, and timing decisions matter more than ever.

As the full retirement age of 67 becomes the unquestioned norm, millions of Americans are being forced to rethink long-held assumptions about when retirement truly begins. The Social Security age rule may be decades old, but its consequences are only now fully arriving—reshaping work, income, and retirement for a generation navigating longer lives and tighter financial margins.